“Risk Comes From Not Knowing What You Are Doing.”

- Warren Buffett

About The Principal

David Lazar is currently a private investor who specializes in "Turnaround Situations" distressed public companies. He is actively seeking high growth private companies who are looking to explore transitioning into the public markets.

David has been involved in the Capital Markets for nearly a decade. He has diverse knowledge of financial, legal and operations management; public company management, accounting, private placements, audit preparation, capital raising, due diligence reviews, and SEC regulations.

David has been involved in the Capital Markets for nearly a decade. He has diverse knowledge of financial, legal and operations management; public company management, accounting, private placements, audit preparation, capital raising, due diligence reviews, and SEC regulations.

Investment Philosophy

David's investment philosophy is looking for “diamonds in the rough". Companies which have long lost favor in the eyes of Wall Street and drastically need a comeback. He seeks to invest in companies for which we can actively work with management in order to restore much needed shareholder value.

In other investment scenarios, when management is already on the right track, he merely seeks to invest in order to join in for the ride. Although this investment strategy comes with substantial high risk, we believe that it can bear great reward. Through this meticulous Due Diligence process that is conducted on every potential investment, he feels that he can properly mitigate avoidable risk.

In other investment scenarios, when management is already on the right track, he merely seeks to invest in order to join in for the ride. Although this investment strategy comes with substantial high risk, we believe that it can bear great reward. Through this meticulous Due Diligence process that is conducted on every potential investment, he feels that he can properly mitigate avoidable risk.

As Warren Buffett once said, “fearful when others are greedy, and greedy when others are fearful.”

Recent Transactions

Indaptus Therapeutics Signs Securities Purchase Agreement With David Lazar

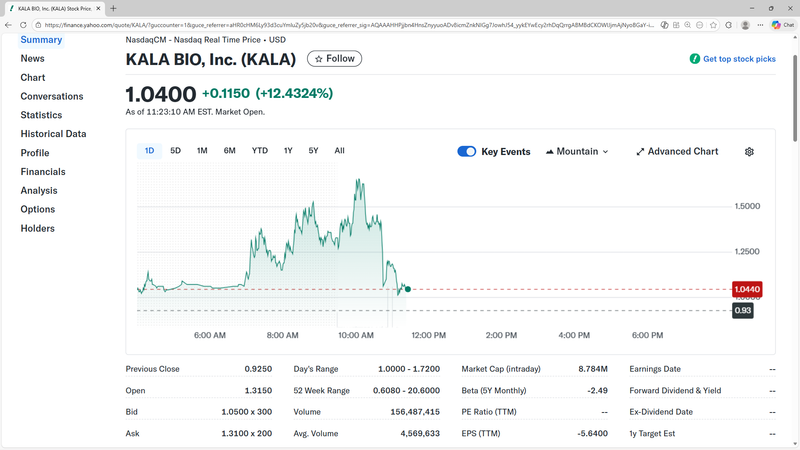

KALA Bio’s Bold Move: A New Dawn?

KALA BIO Announces $10 Million Registered Direct Offering of Common Stock Priced At-The-Market Under Nasdaq Rules

Why Did KALA BIO Shares Jump Over 22% After Hours?

KALA BIO Enters Into $6 Million Securities Purchase Agreement with Investor David E. Lazar

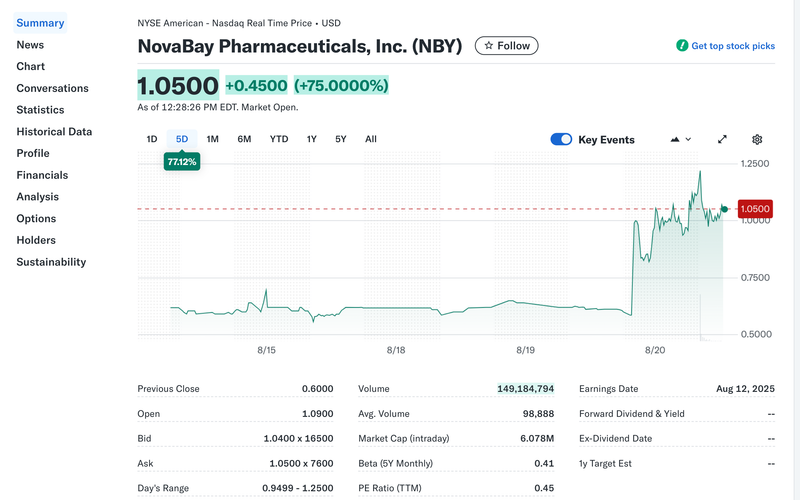

NovaBay Pharmaceuticals, Inc. Regains Compliance with NYSE American Continued Listing Standards

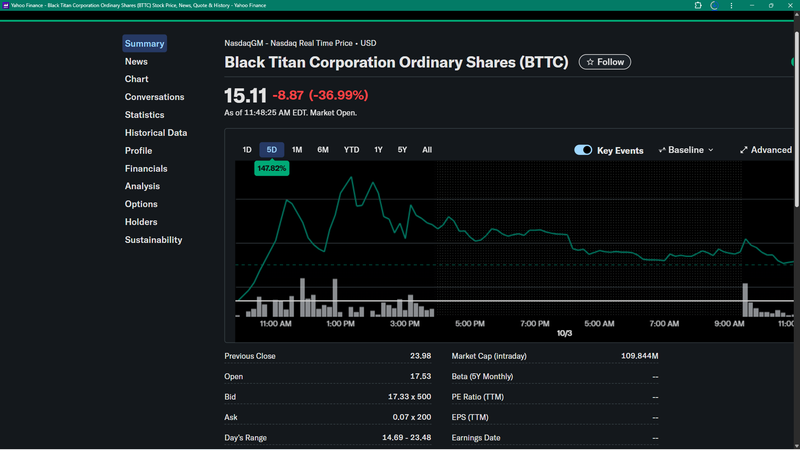

Black Titan (NASDAQ:BTTC) climbed nearly 300% on Thursday as it announced Wednesday the completion of its previously disclosed business combination with Titan pharmaceuticals

NovaBay Pharmaceuticals Announces One-Time Special Cash Dividend of $0.80 Per Share

NovaBay Pharmaceuticals Enters Into $6 Million Securities Purchase Agreement with Investor David E. Lazar

David E. Lazar just filed a 13G for Matinas Biopharma (NYSE:MTNB) on August 15, 2025

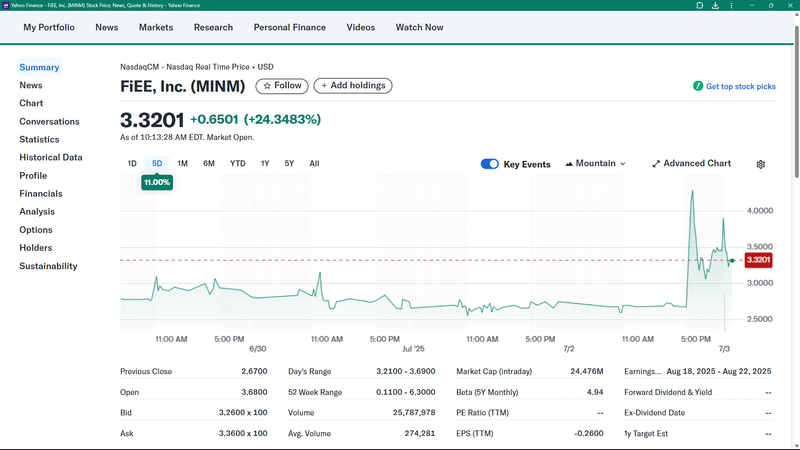

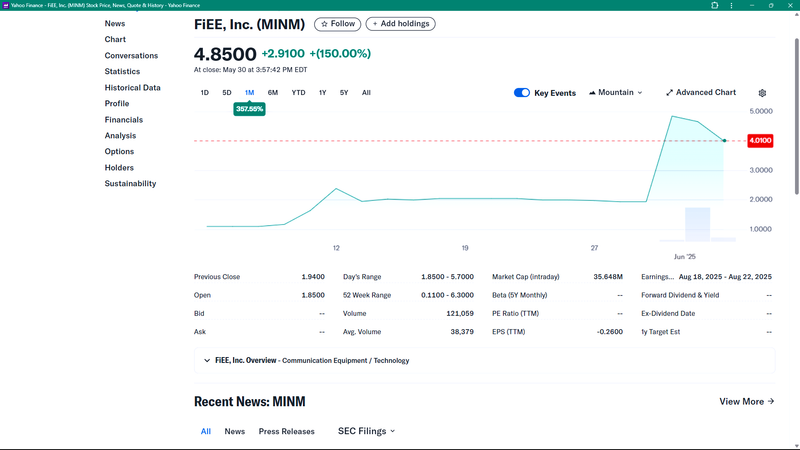

FiEE, Inc. Acquires Advanced Tech Suite Expected to Supercharge IoT-AI Content & Audience Targeting Platform

FiEE, Inc. Closes Its First Day of Trading on NASDAQ

In The News/Blog

|

5 min read

Source: Bloomberg.com, A multibillion-dollar capital markets experiment is unfolding on Wall Street, as entrepreneurs use blank-check companies and reverse mergers to take their holdings of digital assets public.

Read More