Electro-Sensors and Mobile X Global Announce Merger

Public company to launch Mobile X, a disruptive new wireless service provider

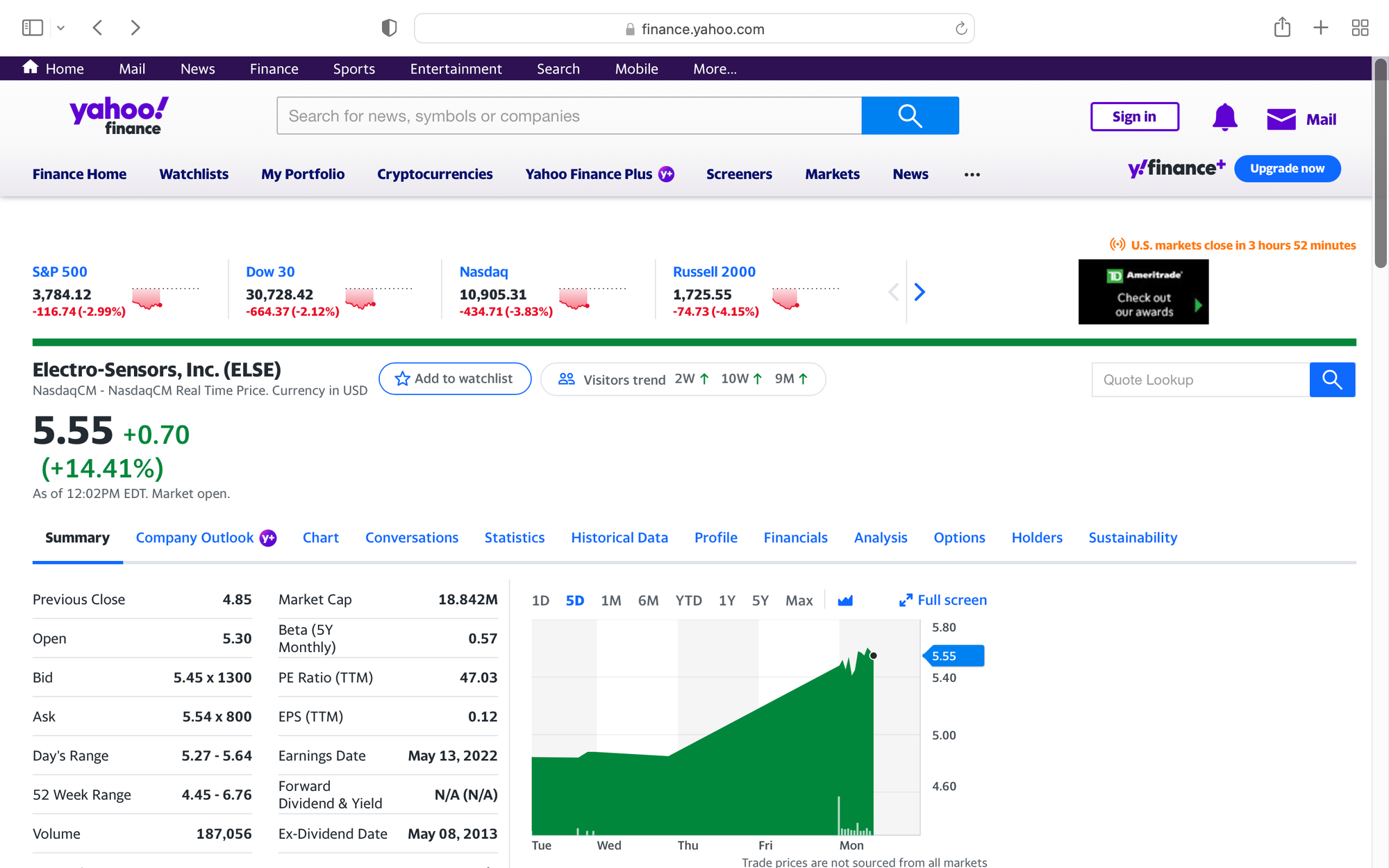

MINNETONKA, Minn. and LOS ANGELES, June 13, 2022 /PRNewswire/ -- Electro-Sensors, Inc. (Nasdaq: ELSE), a leader in industrial monitoring systems, and Mobile X Global, Inc., one of the world's first connectivity-as-a-service companies, announced today that they have entered into definitive agreements to merge and re-name the combined company Mobile X Global, Inc.

Mobile X Global, Inc. will launch Mobile X, a new wireless brand positioned to disrupt the wireless industry. The merger partners also expect Mobile X Global's cloud-native platform to enable synergies between Mobile X and Electro-Sensors' wireless industrial sensor business.

The definitive merger agreement and related transactions have been approved by each company's board of directors and are subject to approval by the shareholders of each company. The directors, officers, and major shareholders of each company, who collectively own a majority of the shares of each company, have entered into agreements obligating them to approve the transactions.

Shares of the combined company are expected to continue to trade on the Nasdaq Capital Market under the ticker symbol "MOBX" upon closing of the merger, expected in the third quarter of 2022.

Launch of Mobile X

In October 2021, Mobile X Global announced a network access agreement to enable the launch of a new AI-powered mobile business for wireless customers. The company will use its proprietary CaaS-AI (Connectivity-as-a-Service-AI) cloud-native platform, XO.1, and its network agreement, to provide personalized wireless data, voice, and messaging services, initially to customers nationwide across the U.S., with a commercial launch expected later this year. The company expects to further expand internationally under the Mobile X brand, leveraging the XO.1 platform capabilities to create a seamless global connectivity experience for its customers.

Mobile X intends to employ artificial intelligence, machine learning, and real-time usage information to learn each customer's unique connectivity requirements and provide optimized individual pricing, supported by a premier app-enabled experience. The seamless experience and potential cost savings for the majority of customers are expected to lead the industry, enabling customers to pay only for the services they use. The XO.1 platform will allow customers to seamlessly switch across multiple global networks, with one number and one service that extends beyond borders.

"This merger, like the one that I engineered to create Digital Turbine, will position us for rapid growth," stated Peter Adderton, founder and CEO of Mobile X Global. "We believe the new combined company will also provide the vehicle for future expansion, so that we can serve a new generation of borderless consumers and use our proprietary XO.1 platform to help connect the billions of IoT devices expected worldwide. Mobile X customers will get unprecedented levels of customized service and only pay for what they use. We expect to help millions of wireless customers save money at a time when they really need it."

Merger Structure and Ownership

After the merger, Mobile X Global shareholders are expected to own approximately 76% of the combined company, Electro-Sensors shareholders approximately 11%, and new equity investors approximately 13%, all based on current ownership of the two companies and $20 million of new equity financing on the terms in a commitment letter described below. In addition to their continuing interest in the combined company, Electro-Sensors shareholders as of a record date to be determined before the closing will receive special cash dividends expected to total approximately $18 million, with the actual amount of the dividends subject to adjustment based on the transaction expenses, working capital balance, and any indebtedness of Electro-Sensors at closing.

Cash dividends of $18 million would be approximately $4.83 per fully diluted share of Electro-Sensors, whose closing price on June 10, 2022, was $4.85. In addition, the continuing ownership of Electro-Sensors' legacy shareholders will give them the opportunity to participate in the long-term value to be created by the combined company through Mobile X's planned disruptive entry into wireless communications, synergies expected from enhancing Electro-Sensors' wireless sensor business with the capabilities of Mobile X Global's XO.1 platform, the increased scale of the new organization, and the sharing of best practices.

In connection with the merger, a third-party institutional investor has entered into a commitment letter with Mobile X Global to provide equity financing of up to $20 million upon closing of the merger, subject to diligence and definitive agreements satisfactory to the investor, including an agreement for a $50 million equity line of credit to be provided by the investor. The equity line of credit will provide significant additional liquidity, at the option of Mobile X Global.

Electro-Sensors Voting Agreement and Special Meeting of Shareholders

In connection with the execution of the merger agreement, Electro-Sensors' directors, officers, and major shareholders, who collectively own a majority of Electro-Sensors' outstanding shares, have entered into agreements to vote their shares in favor of the merger at a special meeting of shareholders to be held before the closing on a date to be announced.

Closing will follow the special meeting of shareholders of Electro-Sensors, consent of shareholders of Mobile X Global, and satisfaction of other customary closing conditions, including the U.S. Securities and Exchange Commission (the "SEC") having declared effective a registration statement, and The Nasdaq Stock Market having approved the listing of the common stock of the combined company.

David Klenk, CEO of Electro-Sensors, said, "We believe this merger will be very good for the customers, employees and shareholders of Electro-Sensors. Our shareholders will receive a significant cash dividend and retain a meaningful share of an exciting platform company that we expect will also create new opportunities for our sensor business."

Other Information about the Merger and Related Transactions

The transaction is structured as a statutory reverse triangular merger under Delaware and Minnesota law, under which a newly formed subsidiary of Electro-Sensors, Inc. will be merged with and into Mobile X Global, Inc., with Mobile X Global, Inc. surviving the merger and becoming a wholly owned subsidiary of Electro-Sensors, Inc. Electro-Sensors, Inc. will reincorporate in Delaware, be re-named Mobile X Global, Inc., and operate both the new Mobile X wireless business and the Electro-Sensors business.

Additional information about the proposed transaction, including a copy of the merger agreement, will be provided in a Current Report on Form 8-K to be filed by Electro-Sensors with the SEC and made available at www.sec.gov. More information about the proposed transaction will also be described in Electro-Sensors' registration statement and related documents relating to the merger, which it will file with the SEC.

Management and Governance

Upon closing of the merger, Peter Adderton, chairman and chief executive officer of Mobile X Global, will become the chairman and chief executive officer of the combined company. Mr. Adderton has decades of experience creating and operating digital platform businesses, including his former roles with Digital Turbine (Nasdaq: APPS), which currently has a market capitalization of approximately $1.7 billion and mobile virtual network operator (MVNO) Boost Mobile. Mobile X Global's management team has decades of experience operating large telecom providers and rapidly scaling private and public companies. Mobile X Global and Electro-Sensors are committed to retaining Electro-Sensors' existing employees and customers. Senior management of Electro-Sensors is expected to continue and assist in the integration of the combined company and the operation of the existing sensor business.

When the transaction closes, the current directors of Electro-Sensors will resign, and the Board of Directors of the combined company will initially consist of five members appointed by Mobile X Global.

Advisors

B. Riley Securities is financial advisor and Proskauer Rose LLP is legal counsel to Mobile X Global on the transactions. Lake Street Capital Markets is financial advisor and Ballard Spahr, LLP is legal counsel to Electro-Sensors for the transactions.

About Mobile X Global, Inc.

Mobile X Global, Inc., one of the world's first connectivity-as-a-service-AI companies, is a new entrant in the global mobile industry founded by Peter Adderton, who also founded Boost Mobile and Digital Turbine (Nasdaq: APPS). Mobile X Global plans to launch a new mobile brand called Mobile X in the U.S. in 2022, designed to attract displaced and mistreated wireless customers by offering simple, great value prepaid wireless services and experiences. Enabled by a network access agreement with a major carrier and supported by Mobile X Global's proprietary XO.1 cloud platform and an AI-powered on-device application, Mobile X will offer each customer their own unique service and ensure they only pay for what they use.

About Electro-Sensors, Inc.

Electro-Sensors, Inc. is an industry leading designer and manufacturer of rugged and reliable machine monitoring sensors and wireless/wired hazard monitoring systems applied across multiple industries and applications. These products improve processes by protecting people, safeguarding systems, reducing downtime, and preventing waste. Electro-Sensors is proud to be an ISO9001:2015 quality certified company and is committed to providing excellent customer service and technical support. Founded in 1968 and located in Minnetonka, Minnesota, Electro-Sensors provides its loyal customers with reliable products that improve safety and help plants operate with greater efficiency, productivity, and control.

Important Information and Where to Find It

A full description of the terms of the transaction will be provided in a proxy statement/prospectus/consent solicitation statement included in a Form S-4 Registration Statement that Electro-Sensors will file with the SEC. ELECTRO-SENSORS URGES INVESTORS, SHAREHOLDERS AND OTHER INTERESTED PERSONS TO READ, WHEN AVAILABLE, THE PROSPECTUS/PROXY STATEMENT/CONSENT SOLICITATION STATEMENT AS WELL AS OTHER DOCUMENTS FILED WITH THE SEC BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT ELECTRO-SENSORS, MOBILE X GLOBAL, AND THE PROPOSED TRANSACTIONS. When final, the definitive proxy statement will be mailed to Electro-Sensors' shareholders as of a record date to be established for voting on the proposed transaction, and a definitive consent solicitation statement will be sent to the Mobile X shareholders. Shareholders will also be able to obtain a copy of the documents (when available), without charge, by directing a request to: Electro-Sensors, Inc., 6111 Blue Circle Drive, Minnetonka, MN 55343. These documents, once available, can also be obtained, without charge, at the SEC's website (www.sec.gov).

Participants in the Solicitation

Electro-Sensors, Inc., Mobile X Global, Inc., and their respective directors and executive officers may be considered participants in the solicitation of proxies by Electro-Sensors, Inc. in connection with the proposed transaction. Information about the directors and executive officers of Electro-Sensors, Inc. is set forth in its Annual Report on Form 10‐K for the fiscal year ended December 31, 2021, and its 2022 Proxy Statement, which were filed with the SEC on March 31, 2022. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from Electro-Sensors' shareholders in connection with the proposed merger will be included in the definitive proxy statement/prospectus that Electro-Sensors intends to file with the SEC.

Non‐Solicitation

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of that jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Forward Looking Statements

This press release includes certain forward‐looking statements concerning Electro-Sensors, Mobile X Global and the proposed transactions within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding future financial performance, future growth, and the development of future products and services; the benefits of the proposed transactions, including anticipated growth and synergies; the combined company's plans, objectives and expectations and intentions; the expected timing of the proposed transactions; and future acquisitions. These statements are based on current expectations or beliefs and are subject to uncertainty and changes in circumstances. There can be no guarantee that the proposed transactions described in this press release will be completed, or that they will be completed as currently proposed, or at any particular time. Actual results may vary materially from those expressed or implied by the statements here due to changes in economic, business, competitive or regulatory factors, and other risks and uncertainties affecting the operation of Electro-Sensors as well as the business of Mobile X Global. Many of these risks, uncertainties and contingencies related to Electro-Sensors are presented in Electro-Sensors' Annual Report on Form 10‐K and, from time to time, in Electro-Sensors' other filings with the SEC. These and other risks related to the business of Mobile X Global will be presented in the proxy statement/prospectus/consent solicitation statement to be filed with the SEC.

The information here should be read considering these risks and the following considerations: the ability of the merger parties to obtain definitive investment documents and close on the equity investments necessary to complete the merger; the ability of Mobile X to successfully launch its business, attract subscribers, and achieve the levels of customer service, revenues and costs that it currently expects; the ability of the combined company to successfully maintain a Nasdaq Capital Market listing; the ability of the combined company to successfully access the capital markets to finance expansion and acquisitions; the ability of the combined company to identify and acquire appropriate acquisition targets and successfully integrate these companies into its operations; the ability of the combined company to achieve synergies between its legacy sensor business and its new Mobile X business; the conditions to the closing of the merger may not be satisfied or an event, change or other circumstance could occur that could give rise to the termination of the merger agreement; the merger may involve unexpected costs, liabilities or delays, resulting in the merger not being consummated within the expected time period; risks that the announced merger may disrupt current Electro-Sensors plans and operations or that the business or stock price of Electro-Sensors may suffer as a result of uncertainty surrounding the merger; the outcome of any legal proceedings related to the merger; and Electro-Sensors or Mobile X Global may be adversely affected by other economic, business, or competitive factors.

SOURCE Mobile X Global, Inc.