No Product, No Sales, No Prospects? Consider a Reverse Merger

- Reverse takeovers are alternative way to take a company public

- Public listings anecdotally have a value up to $25 million By Amy Or

Source: bloomberg.com/news/articles/2023-08-29/no-product-no-sales-no-prospects-consider-a-reverse-merger

August 29, 2023

By: Amy Or

When all else has failed and a publicly traded company has no product and no prospects, it still has one thing that is worth a pot of gold — its listing.

These shell corporations are becoming sought after by companies looking to go public through reverse mergers — where a private company takes over a public one — as investors remain weary of initial public offerings, especially for biotechnology companies.

“The IPO market for biotech right now is not that open,” said West Riggs, head of equity capital markets at Truist Securities. “It’s cleaner, easier and quicker to do a reverse merger if you can find the right target."

Clean because companies don’t have to jump through all the hoops related to marketing an IPO. The fact that a reverse merger can happen without additional funds being raised, means it is also less susceptible to market conditions and investor appetite. That is particularly important for biotechnology companies as they typically have a long journey of clinical trials before they become income-generating businesses.

Biotech companies are often on the other side of the reverse merger as well, after their failure to develop a new drug or treatment sends their shares slumping, making them attractive acquisition targets. What’s more, many have money left in the bank from unused capital. And there are a surprising number of them. Capital IQ estimates around 130 such firms among listed biotechs that could be prime targets for reverse mergers.“

You’ve got a company, in the case of life sciences usually, that’s sitting on a pile of money and its clinical pipeline went away,” said Anna Pinedo, partner and co-leader of Mayer Brown LLP’s global capital markets practice. “They would like to monetize the fact that they’re public."

Public listing status was worth up to $25 million in past reverse mergers, according to Chris Barnstable-Brown, a corporate partner with law firm Wilmer Cutler Pickering Hale and Dorr LLP.

Recent Cases

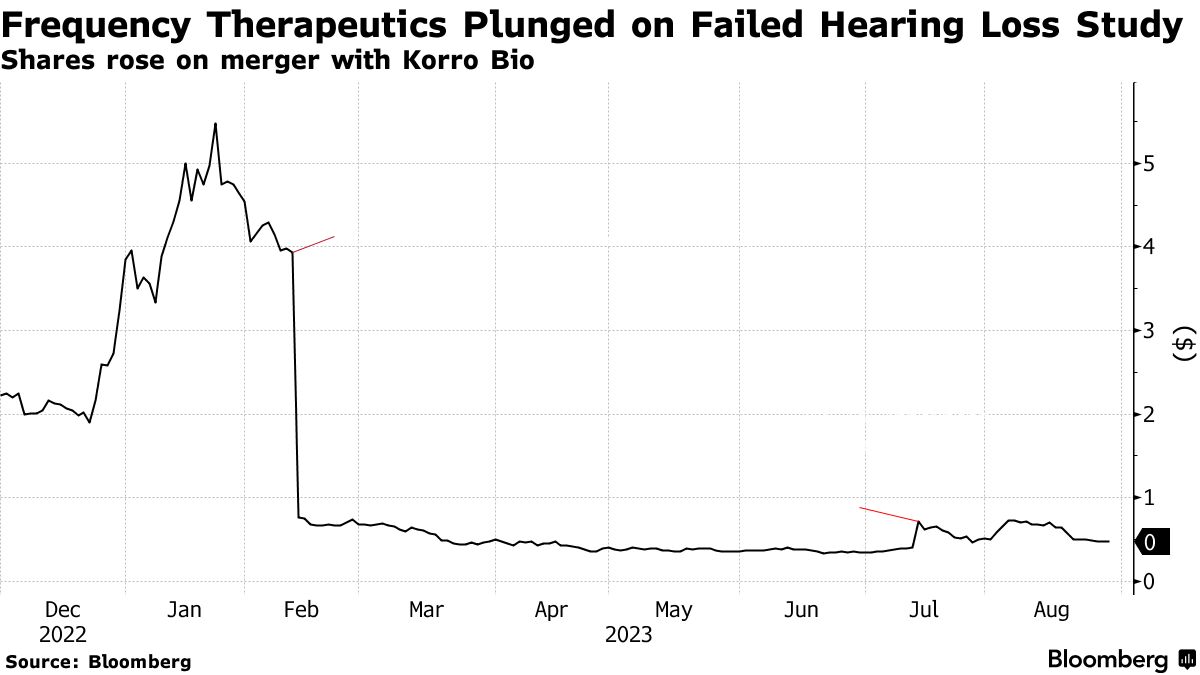

There have been a few such deals already this year. Korro Bio Inc. merged with Nasdaq-listed Frequency Therapeutics Inc. in July after Frequency, with $55 million in unutilized net cash, said its hearing loss treatment program failed to achieve efficacy and discontinued its multiple sclerosis treatment research.

Nasdaq-listed Talaris Therapeutics Inc. said in June that it agreed to merge with Tourmaline Bio, after the death of a patient last year prompted the company to review and then discontinue two clinical trials in kidney transplant tolerance in February and pause its third and final trial the following month. Talaris reported cash and cash equivalents of $181.3 million as of the end of 2022.

To be sure, reverse mergers are nothing new. In fact, they predate the special purpose acquisition companies, or SPACs, that were all the rage until a year ago. But in the cash of SPACs, investors can redeem their cash after a deal has been announced, depriving the newly listed company of funds.

In a SPAC, “you thought it was $100 million, but then 95% of people redeem and there’s $5 million still sitting there,” said WilmerHale’s Barnstable-Brown. “In reverse mergers, there’s no redemption feature.” Recent deals also incorporated private investments in public equity, or PIPEs, allowing companies to tap new funds, on top of the listed company’s cash.“

In lieu of an active IPO market, it is an opportunity for a private company to go public through a reverse merger and also secure institutional capital through a PIPE financing,” said David Stadinski, a global co-head of equity capital markets at Piper Sandler.

Korro secured $117 million in commitments from life sciences investors co-led by Surveyor Capital and Cormorant Asset Management as concurrent financing of the reverse merger agreement, while Tourmaline raised $75 million in private placement from a group including Deep Track Capital and Great Point Partners.

The newly raised capital often partly funds a one-time dividend payout to the target’s existing shareholders, to sweeten the deal, and ensure the reverse merger goes through.

"The company’s shareholder base tends to be more retail focused, so it’s just harder to get people to the table to vote,” said WilmerHale’s Barnstable-Brown. “It’s not that they necessarily vote against your deal, often just trying to find them can be challenging. So having a package of cash and ownership can be attractive.”